Executive Summary

In the early days of Project and Portfolio Management (PPM), it was believed that any business embarking on the discipline had an automatic license to improve an organization’s ROI. Yet, today, there is strong evidence that ROI has not improved. Year after year, industry analysts report that project failure rates are high and, as a result, businesses are failing to effectively manage spending and maximize value from their investment.

While that is the state of PPM, opportunities exist to dramatically improve the return on portfolio investments. Along with integration and portfolio analytics, the inability to effectively manage project and portfolio financials

is repeatedly identified as a root cause of low project success rates and subsequent loss of planned value. Employing solutions which provide PPM with financial intelligence will boost success rates and help companies realize the promised benefits and returns. In this paper, we focus on portfolio financial intelligence; why it is so critical to successful PPM and how to introduce it in your own organization.

The Failures of Traditional PPM

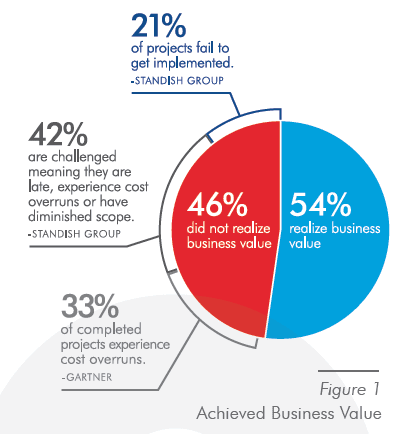

Reports have estimated that some $40 billion has been invested in PPM processes and tools over the last 13 years yet the average PPM maturity level has risen only marginally, from 1.37 to 2.37 on Gartner’s PPM Maturity Model1 which ranges from Level 1 (reactive) to Level 5 (effective innovation). The Standish Group revealed in its 2012 CHAOS Manifesto2, that 43% of projects are delivered late or over budget and 18% fail to be completed or implemented, and Gartner3 reports that 33% of completed projects experience cost overruns.

Reports have estimated that some $40 billion has been invested in PPM processes and tools over the last 13 years yet the average PPM maturity level has risen only marginally, from 1.37 to 2.37 on Gartner’s PPM Maturity Model1 which ranges from Level 1 (reactive) to Level 5 (effective innovation). The Standish Group revealed in its 2012 CHAOS Manifesto2, that 43% of projects are delivered late or over budget and 18% fail to be completed or implemented, and Gartner3 reports that 33% of completed projects experience cost overruns.

The Project Management Institute (PMI)®4 reports that 33% of projects did not meet their goals or business intent and UMT360’s experience, based on hundreds of PPM engagements, shows that dismal project success rates are costing businesses up to 46% of their planned business value. That 46% is in line with Gartner research5 which has found that, on average, 40% of projects do not achieve their planned benefits (See Figure 1).

The net effect is a crisis of confidence in the PMO and business leaders demanding more from their PMO functions. Executives want to see higher project success rates and a portfolio that consistently delivers expected returns for the company. They are asking for more than traditional PPM is able to offer so PMOs must be able to show they have evolved and understand what they need to add to their PPM to ultimately see an increase in realized value and ROI.

Why You Need Portfolio Financial Intelligence

It is Portfolio Financial Intelligence (PFI) that provides the pragmatism and accountability required for companies to realize their planned value and achieve the desired ROI from their investment portfolio. Today, a majority of companies fail to use financial management best practices with their PPM processes leaving them unable to accurately gauge the economic impact of underperforming projects and proactively take corrective action. Many are hindered by the reliance on the wrong software tools such as spreadsheets and ERP systems.

Commonly used to manage and model departmental and project financials, spreadsheets lack the ability to manage volume and velocity of information and data streams, standardization and governance capabilities, and standard and consistent data interpretation and presentation. ERP systems may provide the static chart of accounts view needed by the finance team, but they focus on organizational accounting that does not go beyond budget discussions and financial reporting. They lack the ability to support investment analysis, decisions and management. And traditional PPM solutions, for their part, provide strong execution-oriented project and resource management capabilities but are unable to provide the level of detail and granularity required to make selection, planning and tracking decisions.

Organizations with a high degree of Portfolio Financial Intelligence enable their business to make better investment decisions and assist in project tracking, prioritization and investment analysis. Additionally, they experience improved alignment and communication with the business.

Successfully Adding PFI to Your PPM

As we’ve worked to improve PFI, we’ve seen four critical factors emerge which must be addressed in order to successfully integrate financial intelligence with traditional PPM to avoid losing out on planned value.

- Estimating: The most obvious factor is estimating costs which is the base for all PPM processes and affects selection, planning and tracking. Understanding the costs associated with an investment is critical to developing a business case to justify an investment. The impact of faulty estimates is significant. Overestimating benefits or underestimating costs results in the organization investing in the wrong projects. Equally dangerous is the rejection of strong investments based on benefits and cost errors. Poor estimating reduces the value that organizations get from investments and decreases the confidence between the PMO or IT and the business.

- Metrics and Variance Analysis: Metrics are required to understand what happened, why it happened and what will happen. Metrics are your indicators of success or failure and variance analysis gives you an explanation or understanding of why it’s happening so that you’re able to take corrective action such as proactively cancelling a project, committing more funds or reallocating dollars to other initiatives. Failure to measure, track costs and take action becomes yet another contributor to the erosion of planned business value and the trust between business and PMO or IT.

- Portfolio Integration: Most organizations have built their project portfolio decision systems on isolated foundations where newly proposed projects fail to explicitly consider reusability and the total economic impact of the decisions. Project decisions are increasingly required conversations amongst the program manager’s office (PMO), applications managers and line of business. Visibility into the interrelationships and dependencies that exist within the portfolio will help an organization build a dynamic blueprint of the business and technology architecture, effectively communicate, and understand the impacts of selection, funding, delaying, changing scope or cancelling initiatives.

- Governance: One of the most dramatic errors an organization can make is to tolerate lax governance. Governance is about process and decision flows, approvals and participation rules, roles and responsibilities. It is about enforcing process and data standards, setting financial constraints as well as auditing and compliance. Lax, or the absence of, governance will negatively impact the consistency of decisions and the ability of the organization to address risk and compliance exposures.

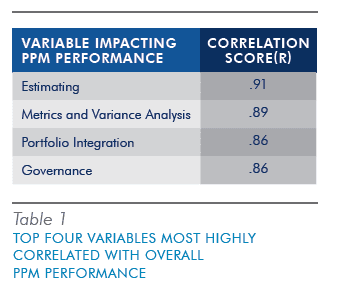

Organizations should attempt to drill down into each of the four critical factors above to begin to understand how to overcome their unique challenges and where to focus. To assist in that endeavor and to better gauge where to focus initially, a correlation analysis can be used to evaluate the factors impacting the effectiveness

Organizations should attempt to drill down into each of the four critical factors above to begin to understand how to overcome their unique challenges and where to focus. To assist in that endeavor and to better gauge where to focus initially, a correlation analysis can be used to evaluate the factors impacting the effectiveness

of the project portfolio.

A correlation coefficient is a statistical measure that rates degree to which two variables are related. The closer the correlation score® is to +1, the more closely change in one variable will impact the PPM’s performance. When we look at the four critical factors as performance variables, we see how strong their correlation is PPM performance. For many of our clients the most obvious starting point has been to focus on the lowest scoring variable first (See Table 1).

Getting Started

Many will look to their existing PPM to address those factors. If the new PPM is to work effectively, organizations must embrace and commit to Portfolio Financial Intelligence. It provides valuable insight into project financials that significantly improves decision making throughout the project lifecycle, allows companies to better manage business investments, and creates a durable advantage that can impact your competitive position.

There are no barriers to entry and organizations should begin with a phased approach.

- Adopt Financial Management Best Practices

In phase one, PFI best practices are introduced as the organization begins customizing and standardizing processes and data, and creates efficient workflows to address various work streams. Equally important is the establishment of maxims such as the basic categorization of spending or the business case being the only way to secure project funding. - Integrate with Line of Business Systems

Once appropriate financial governance controls are established, the next step is integration with the ERP system to collect actual cost data from the financial system of record. Automating the data collection drives data integrity between the ERP system and PFI solution and consolidates financial information into a single system to effectively track financial performance. With access to up-to-date financial data, finance and PMO teams can spend more time analyzing the portfolio rather than manually building report packs and ad hoc reports. - Analyze Portfolio and Optimize Capital Spend

This phase is about establishing selection, funding mechanisms and financial modeling. Having standardized and automated the collection of financials and variance metrics, companies now have the foundational data needed to adopt a dynamic process to effectively evaluate the project portfolio on a regular cadence to optimize capital spend This allows the organization to gauge the real economics of project performance and then proactively reallocate funds to maximize ROI from every dollar invested in strategic initiatives. - Establish a Benefits Realization

Most organizations fail to implement a benefits realization framework and, as a result, fail to reap the full benefits from their investments. We all know that people succeed when they have a benefits and value realization measurement system that is consistently used. Next, we need to ensure that learning and improvement is measured and communicated.

Conclusion

Managing project portfolios in a financially intelligent way is very different from managing project schedules. Project financial management focuses on accurate costs and credible benefits estimates rather than soft and loose assessments of opportunities. It runs counter to the culture of “just do it”. Most organizations have a tendency to ignore the importance of the project financial discipline. Moreover, strong financial management involves some investment in the project financial management process.

Project financial management has significant ROI. Many of our clients which have implemented PFI have experienced an 8 to 12% lift in their portfolio ROI. While, good PFIcannot reduce waste completely, it helps managers think thoroughly about the rationale of their investments and search for the best value/cost relation throughout the project lifecycle. This change in thinking and behavior will neutralize their tendency to gamble without a clear understanding.

References:

1. Lars Mieritz and Donna Fitzgerald, IT Score Overview for Program and Portfolio Management, Gartner, 17 April 2012

2. CHAOS Manifesto 2012, The Standish Group

3. Gartner IT Key Metrics Data, December 2012

4. Pulse of the Profession, Project Management International (PMI), March 2012

5. Michael Smith, Dave Aron and Bill Swanton, CFO Advisory: Benefits Realization Overview, Gartner, 10 February 2012